The Enrolled Agent exam is taken by candidates who wish to become Enrolled Agents. Enrolled agents represent U.S. taxpayers before the IRS. This is the highest credential awarded by the IRS.

There are two ways to become an enrolled agent. Those who have worked at the IRS for five years and have passed a background check can become an enrolled agent. However, the most common path to this designation is by taking the Enrolled Agent exam (EA Exam).

The EA Exam, also known as the Special Enrollment Exam (SEE), is a three-part exam that is administered by Prometric. Hopeful candidates must pass each section of the EA test in order to be given the designation.

Summary: Review some of the Enrolled Agent exam questions below.

Enrolled Agent Exam Questions

We have compiled a list of free EA Exam practice exams, resources, and study guides.

| Resource | Notes | Number of Questions |

| Special Enrollment Examination Questions + Answers | Sample questions written for the purpose of providing test candidates an understanding of the types of questions that may appear on the EA exam. | 60 |

| Special Enrollment Examination: Exam Prep | A comprehensive study guide to review details about individual and corporate tax processes and procedures. | Mix of lessons + flashcards |

| Gleim Exam Prep | Largest and most realistic bank of exam-quality questions. | 300 |

| Prometric Practice Exam | A practice exam created by the makers of the EA exam. | 100 |

| Enrolled Agent Exam Practice & Flashcards | Flashcards focusing on EA exam questions. | 346 flashcards |

| Free Enrolled Agent Assessment | A practice assessment covering all three parts of the exam. Must input some information to get the free enrolled agent exam. | 200 |

Enrolled Agent Exam Outline

In order to become an enrolled agent, you must achieve passing scores on all three parts of the EA Exam. The EA exam has been designed to test competence relating to tax matters for the purposes of having the privilege of representing taxpayers for the IRS. The exam is broken down into three sections.

| Section | Description | Percentage of Exam | Number of Questions |

| 1 | Individuals | 33% | 100 Multiple-Choice Questions |

| 2 | Businesses | 33% | 100 Multiple-Choice Questions |

| 3 | Representation, Practice, and Procedures | 33% | 100 Multiple-Choice Questions |

Each of the three exam parts has 100 multiple-choice questions. Exam takers will be allowed 3.5 hours to complete each section and an additional 30 minutes for a required computer tutorial. While all of the questions are multiple-choice, there are three potential formats that each question is given in. These formats include direct questions, incomplete sentences, and choosing “all of the following, except.”

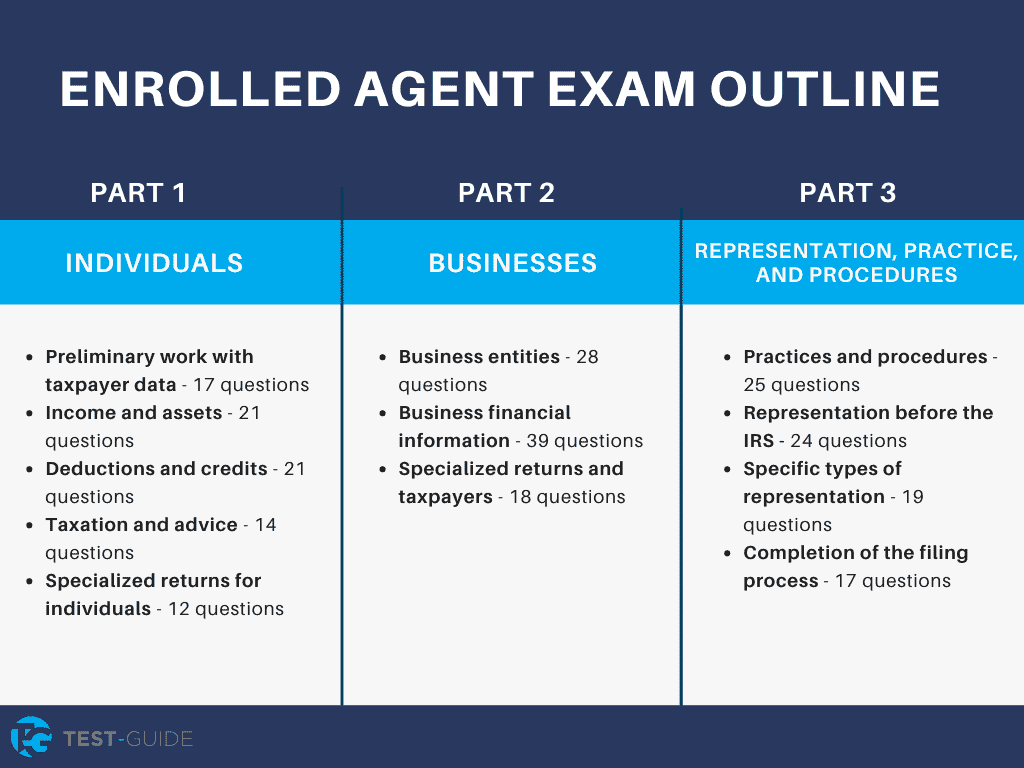

Each of the three sections is broken down into focus questions as followed:

Part 1 – Individuals

- Preliminary work with taxpayer data – 17 questions

- Income and assets – 21 questions

- Deductions and credits – 21 questions

- Taxation and advice – 14 questions

- Specialized returns for individuals – 12 questions

Part 2 – Businesses

- Business entities – 28 questions

- Business financial information – 39 questions

- Specialized returns and taxpayers – 18 questions

Part 3 – Representation, Practice, and Procedures

- Practices and procedures – 25 questions

- Representation before the IRS – 24 questions

- Specific types of representation – 19 questions

- Completion of the filing process – 17 questions

This breakdown can help candidates understand what they need to focus on and how their time and resources should be prioritized.

Enrolled agent candidates do not have to take the exam in section order, meaning starting with Section 1 and ending with Section 3. Generally, candidates decide to complete the sections from easiest to hardest. This means that many complete Section 3 first, then go on to Section 1, and then save Section 2 for last. Section 2 has the lowest exam pass rate at around 60%, whereas Part 1 and Part 3 have pass rates of 75-80% and 90% accordingly.

The sections of each exam are taken separately on different dates. If a candidate passes one part of the exam, that score is carried over for up to two years. After two years, that score no longer carries over, and the candidate must retake that section.

Enrolled Exam Scheduling, Fees, and Administration

Before you take your exam, make sure that you have all the information you need regarding scheduling, fees, and the administration of the tests.

Scheduling Your EA Exam

You can schedule an exam by making an appointment online here or by calling 1-800-306-3926. Once you have scheduled your appointment, you will receive a confirmation number that you will need to keep if you need to change or cancel your appointment.

How Much Does It Cost To Take the Enrolled Agent Exam?

Each section of the EA exam is $182. There is no fee to reschedule if done at least 30 days prior to the exam date. You will have to pay $35 if you need to reschedule your exam sooner than 30 days and the full fee if you must reschedule within five days of the exam date.

Are There Specific Test Dates for the Enrolled Agent Exam?

There is no testing during the months of March and April. This is to give the exam creators time to update and adjust the exam as needed while new tax laws are going into place. The testing window runs from the beginning of May to the end of February. If you fail a section, please allow 24 hours before scheduling a retake.

How is the EA Exam Administered?

The Enrolled Agent exams are closed book with no access to any reference materials or electronic devices, including during breaks. Paper, pencils, and a calculator will be provided at the examination site. Exams are administered at Prometric test centers and are taken on a computer. There are test centers in most major cities in the US and are open throughout the week, with some locations open on Saturdays and Sundays.

Enrolled Agent Exam Requirements

Be mindful of the EA exam requirements. Make sure that you qualify to take the exam before scheduling and paying a fee. Unlike many professional jobs, you don’t need a degree in a specific field of study—or a degree at all—so you can take the EA exam at any point.

When you arrive at the testing center, you must show at least one unexpired government-issued ID. This ID must include your name, photo, and signature. If you do not bring your ID to the exam, you will be unable to take it and will have to reschedule your test.

Enrolled Agent Exam Scoring

Once you complete your examination, you will be given a pass or fail designation on the computer you took the test on. Your test score report will be emailed to you from Prometric. You will also have access to previously taken test attempts.

A panel of Enrolled Agents and IRS representatives have determined that a passing score is 105. Exam results are scaled. The results are given by calculating the number of questions answered correctly from the total number of questions given.

From there, that amount is converted on a scale that ranges from 40 to 130. If you fail your exam, you will still be given a score so that you are able to see where you fall. If you scored 104, you were very close to the “passing” designation. But, if you scored a 50, you may find that you need to increase your studying and comprehension of the exam materials.

EA Exam FAQs

How many times am I able to take each exam during the testing window?

The testing window is from May through the end of February. In that time frame, you are able to take each exam part up to four times. Note that you will have to pay the $182 fee each time you take the exam.

Do I need a degree to become an Enrolled Agent?

No, a degree is not a prerequisite to becoming an enrolled agent.

How long does it take to prepare for the EA exam?

An enrolled agent candidate can expect to study anywhere from 40-70 hours per examination section. This means you will most likely study for over 200 hours when all is said and done.

Is the EA exam hard?

Yes, the EA exam is considered hard, with varying levels of difficulty between each section. Section 2 that focuses on business is regarded as the hardest part of the examination to pass.

How do I become an Enrolled Agent after I pass the EA exam?

After you pass all three examinations, you must apply for enrollment within one year. You can apply online or by mail. A fee of $67 is required when you apply for enrollment, and processing can take up to 60 days.

During this time, the IRS will conduct a background check that considers your tax compliance and criminal history.